Since we started investing in 2014, we started keeping a record of our annual dividends and interests. While it wasn’t much when we started, it gives us a good sense of accomplishment when we look at how much we have grown our annual passive income with just consistent savings and investment.

Our aim is to generate enough passive income that will replace our annual spending (once we pay off our mortgage). We don’t plan to quit our full time jobs until we pay off our mortgage. So, the goal is to replace our non-mortgage expenses. This seems to be further than where we would ideally like to be. Two main factors affecting are – childcare costs for another year and mortgage payments that restarted when we moved to the UK. We never had to worry about mortgage payments in the USA. We paid off our house as quickly as possible, within a year, since we bought an inexpensive house. We largely lived rent/mortgage free.

How we generate our passive income today

Our primary generator for passive income is through investments. We have a mixture of

- IRA / 401k

- Roth IRA

- Taxable brokerages

- Individual Savings Account

- Workplace Pension

- CDs

We would ideally like to diversify our investment portfolio by adding rental properties and real estate crowdsourcing, but we are hesitant to invest in more real estate without sorting our immigration situation in the UK (anticipated June 2027). Selling properties is difficult on a work permit. It becomes especially challenging when you have 90 days to leave the country if you lose your job while on a visa. Selling houses within 90 days is not a practical expectation. Thus, we would like to keep this at a minimum until the visa is resolved.

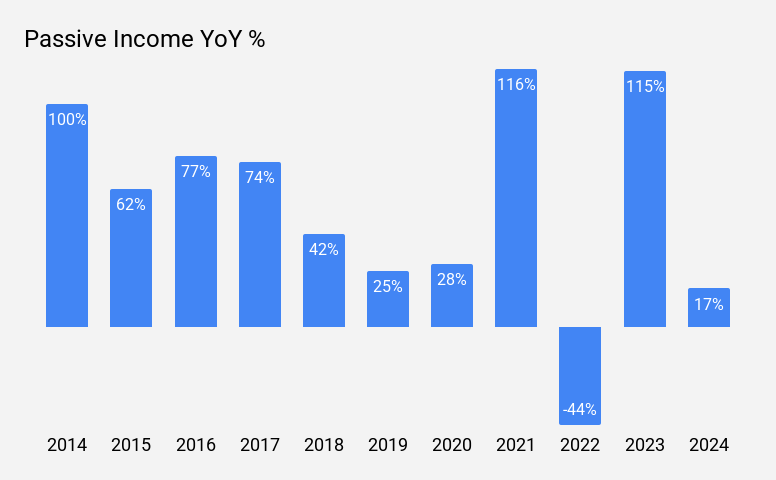

Passive income growth

Our passive income has grown consistently at an average rate of 55% over the past 10 years. While it was easy to have large growths in annual dividends early on since our baseline was very low, it has been tough to keep up the 60 – 70% growth seen in 2015 – 2017.

2021, 2022 and 2023 show unusually high and low growth and the reasons are below

- 2021: We received unusually large amount of capital gain distributions from our mutual funds. They were actively managed funds and while it was nice to get the CGs it was not fun when we have to pay taxes. We are trying to move from mutual funds to ETFs to avoid these tax traps.

- 2022: Due to the 2021 windfall, 2022 dividend growth looks negative. Relative to a normal year of 2020, the growth is 21%.

- 2023: We rolled over all our 401k to IRA since we were no longer employed in the USA and didn’t want to deal with the 401k provider since our previous employer likes to switch 401k providers every 2-3 years. While on the 401k plan, we were unable to see the annual dividends that were generated. Now with our IRA account we can see that so started including them. Hopefully from now on, the growth trends won’t have these huge swings.

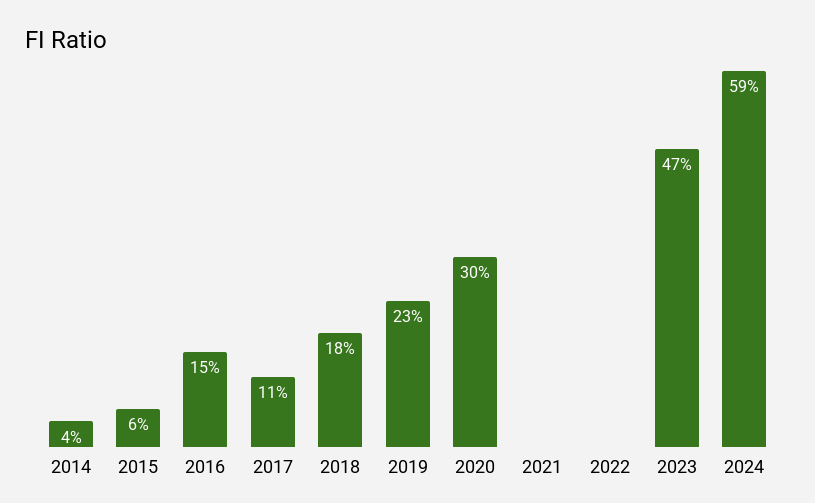

Financial Independence Ratio

Financial independence can mean different things for different people. For us, it is the ability to fully lean on our passive income stream to fund our lifestyle.

FI Ratio = Passive income / Annual Expenditure

We have done a decent job tracking our annual expenses from 2009 until 2020. Things fell off the cliff when our little one arrived, and in between midnight feedings, nappy changes, tummy time and loads of other baby stuff, tracking expenses was the last thing in our mind. Looking back, we are sure that the expenses were much higher than previous years and our FI ratio would have been lower.

Moving to the UK in mid 2022, losing K’s job and trying to determine the cost of living in a new country, we decided to start tracking our expenses. Fingers crossed we do a better job going forward!