In every way that is not financial, October was a fun month. We took a trip to India after two years, and spent Diwali there after nearly 12years. Nearly everything about the trip was fantastic – the food and the family! What was not fantastic – the few days of oppressive unseasonal 42C heat and I thought I would melt! Our son had a fantastic trip – between ice creams everyday, getting spoilt by grandparents and some form of junk food everyday, he would move there tomorrow if he could.

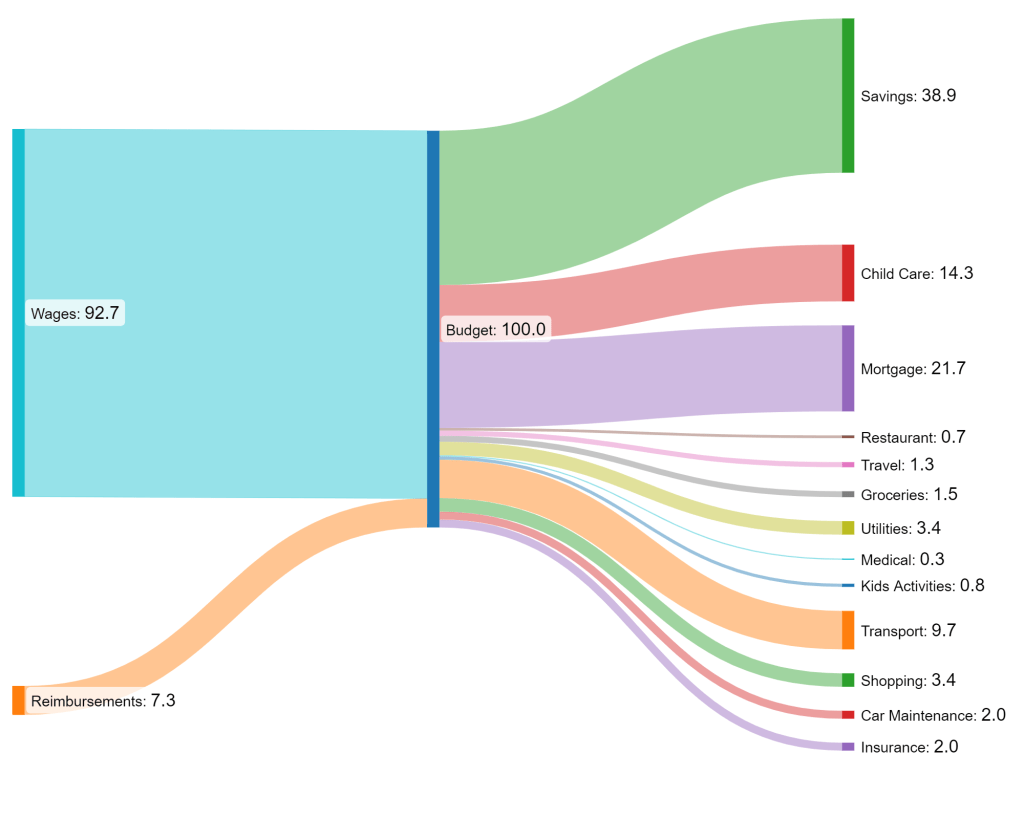

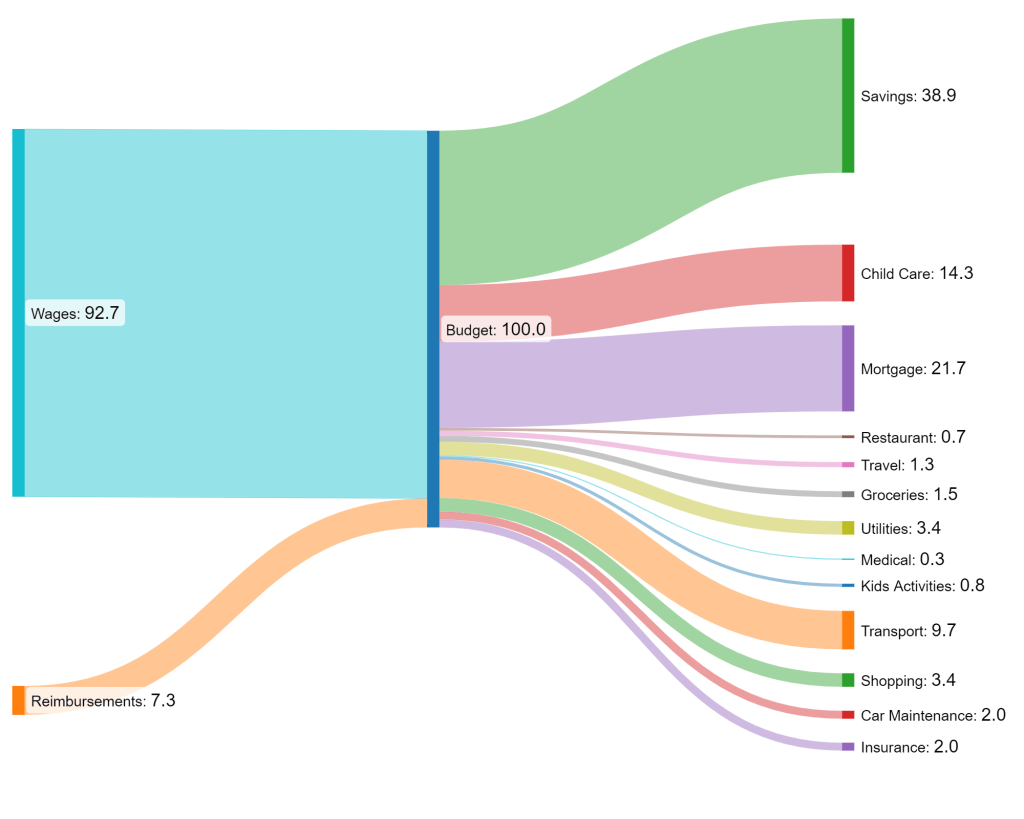

Ofcourse, savings pot takes a hit during a months like these, down by approximately 7%, but that is why we work and save right? In today’s economy, we feel privileged to have jobs that allow us to save, let alone spend on non-essentials like vacations.

Our car also needed new tires, which resulted in the 2% car maintenance costs. This is a category S truly detest spending – oil changes, tires, wiper blades, some random engine noises, whatever the cause, S truly hates it. In contrast to home improvement or maintenance projects, which S has no problem spending on, S has the exact opposite view on cars. We spend atleast 12 hours each day at home, which makes it seem worthwhile to spend on a place. Typically, thoughtful home improvements increase the value of one’s home, allowing us to recuperate the investment. In a car, we spend hardly half hour a day, and any money spent on repairs and maintenance is wasted since a car’s value always depreciates. So every year during annual inspection, S is always put off by it and it goes to K to get the job done!

Leave a comment