June 2024 was a big month for us. K turned 40! And to celebrate we took a little trip to London! It was our first trip to London since moving to UK, and it was the perfect way to mark the milestone year.

Last year, we struggled with little weekend breaks since our son was an extremely light sleeper and needed a silent spot to sleep in his carrying crib. This typically meant a more expensive stay with a second room and either a checked bad (for the crib) or the entire boot of the car filled with the crib. Since December 2023, we decided to experiment with co-sleeping on vacations, and this has made a world of a difference. While it was a hard transition for the first few nights, but it also means we can fit in a standard hotel room, and that means “cheaper” and more vacations!

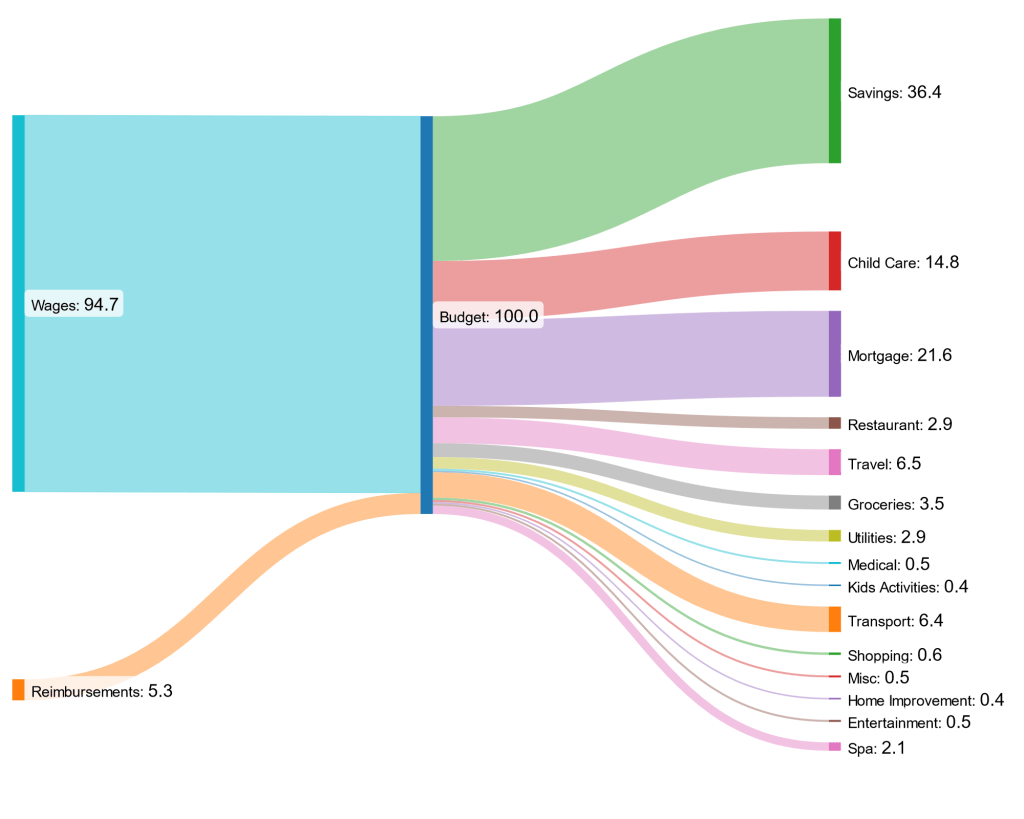

With a “cheaper” vacation now being an option, we headed to London and between fantastic restaurants, unlimited double decker bus rides (and first boat ride for Junior), it ended up being a fun trip! This also meant, our savings, normally at 50%+ dropped to 36% and this is just fine with us. We are also continuing the self-care promise we made in May, and the spa expense continues. Totally worthwhile!

Reflecting a bit on the 40th milestone – Initially, say 15years ago, when we started reading about financial independence and early retirement, 40 sounded like an ideal age to retire, and spend the next 20years in retired-but-fun state until we got to 60-65years. But with life expectancy, and improving quality of older age life, seems like we could be spending most of our lives in a semi-retired form and that is a bit disconcerting. However, now that K is 40, we see how risky retirement at this age can be – our careers are just starting to take off (or took off a bit and now coasting, with potential for growth), our son is still in nursery with atleast 18-20years of expenses ahead, life expectancy is now much longer, and inflation is very high. We also read a lot of articles about early retires feeling aimless after their children are older and do not require them 24×7. Ideally, we would like to work 10am – 2pm, assuming school is 9am to 3pm, which will give us a purpose during the hours childcare is not a priority. And between two part-time jobs amounting to one full-time pay, and a frugal lifestyle, this is very feasible. So when K turned 40, we found ourselves contemplating how naive our thoughts were 15years ago and can now set more realistic targets – which is fun and interesting part-time work, to cover the cost of living and to maintain social interaction to avoid senility.

Leave a comment