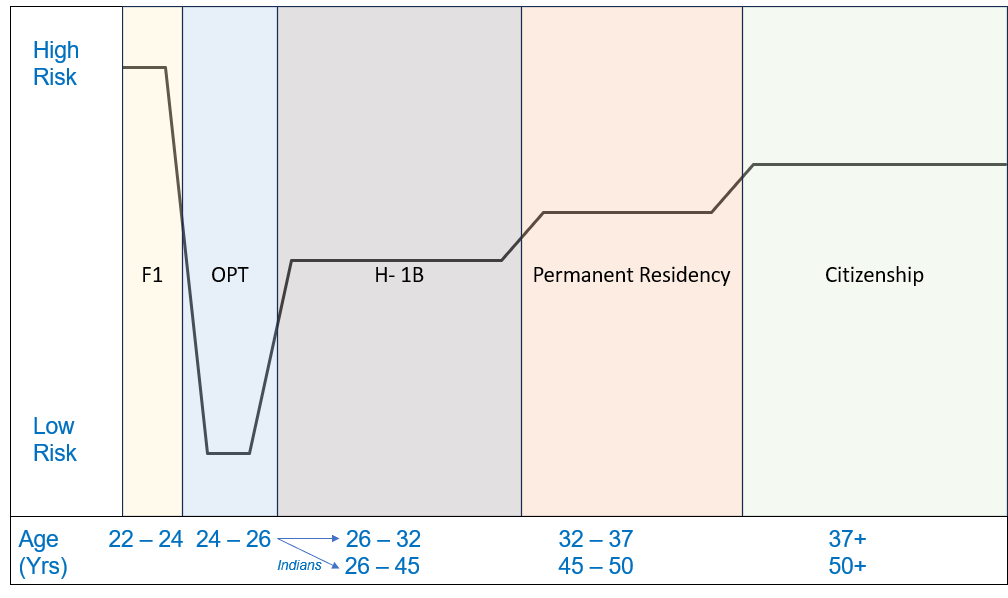

For awhile we debated if this website was about immigration or financial independence, and as we discussed it, we realized over the years a lot of financial decisions were highly dependent on our immigration situation at that time.

For example, we viewed our risk tolerance as something similar to the graph below

- Initially, legal immigrants who enter any country likely come as students. Since we were on F-1 visas in the USA, we have used this as example. Similar student visas, and associated risk sentiments likely exist in UK, Germany, Australia, etc. Basically any country that Indians and Chinese immigrants go to for an education. At the onset, we are poor, and don’t really have any steady source of income. Our only expenditure is daily living expenses while we study, and risk tolerance is naturally very high because there is no downside.

- Once an individual gets a job, and moves to murky OPT status, risk tolerance plummets. Even 401k appears a risky investment because “what if H-1B is not selected in lottery and we need to leave the country in less than 2 years”. Investment decisions, particularly around 401k is driven by this immigration condition.

- The next phase is a relatively stable phase of H-1B, assuming your application is one of the lucky ones selected from hundreds of thousands of applications. If yes, then atleast 6 years residency is guaranteed. From this point on, risk tolerance should increase dramatically for non-Indians, who face a relatively shorter wait time for their permanent residency, aka green card, applications to be approved. Non-Indians are relatively young and can take career risks, and look for aggressive career growth, switch jobs, increase pay and consequently gain an improved financial status. For Indians, this is the true phase of death by a thousand Monthly Visa Bulletins. For the uninitiated, this is the mighty website updated by the state department that tells you when you will be out of this application purgatory. For us, this end never came and we left the country, however many of our friends in mid-to-late 40s are still with their first or second employers, unable to negotiate pay raises or switch jobs easily. Risk is automatically medium-low. Immigrants might buy one house, but not invest in any rental properties. Immigrants may take a smaller mortgage to pay off faster, because one of two spouses might need to take a career break for childcare, and be unable to find re-employment quickly while on a visa. Immigrants also cannot take-up part-time gigs while on visas (acceptable in UK under some conditions, not at all acceptable in USA). There might also be certain investment products that are not open to individuals while on visas.

- The penultimate phase is while an immigrant is a permanent resident. They should be able to take a risk, but your expenses are likely very high with one mortgage, and one or more children. At this point, saving for children’s college education, low risk 529 plans become priority. It also becomes harder to physically uproot young families and relocate to a different city for lucrative employment. Typically, this is also the phase an immigrant needs to send money back to their families in their home countries for medical emergencies.

- And the last phase as citizens – if an immigrant reaches this phase in early-30s, then there is sufficient time to catch up on the financial risk/reward chart. If you reach this phase in late-40s or early-50s, like it would have been for us, there is almost no hope for aggressive financial investments.

Once we realized this above graph and associated reasoning, which will vary marginally for different immigration situations, we realized a strong correlation between visa and finances. We tried recognizing the pros and cons of any investment, in light of visa at that time, and any additional paperwork hassle involved to reverse our financial moves if deemed suitable by job loss while on visa.

Leave a comment