By far, one of our favourite tools for savings is 401k. Let alone the automatic company match and the tax reduction, this is literally the easiest laziest do-nothing approach to building long term wealth.

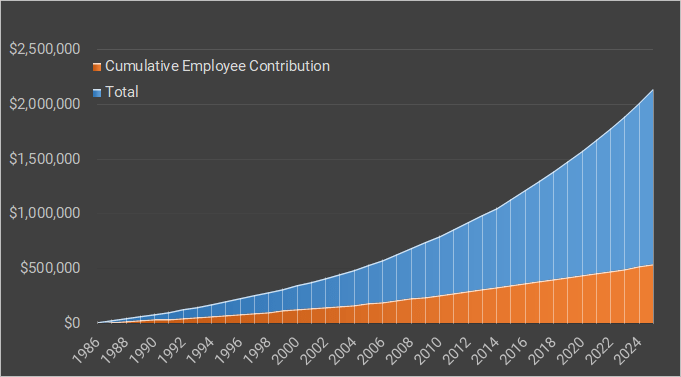

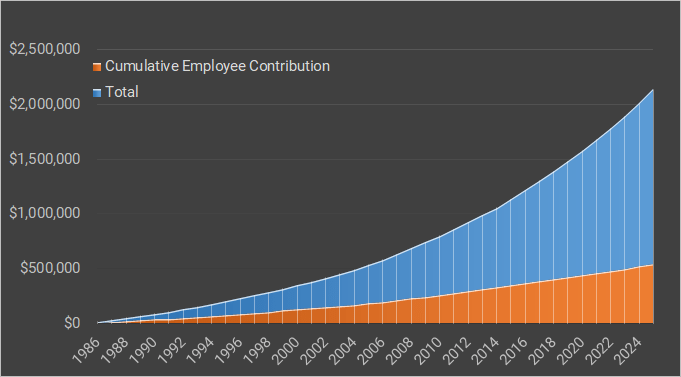

Let’s imagine you have suddenly woken up and it is 1986 and you are starting your first full-time job and 22 years old. Median weekly wage across all professional specialty occupation, i.e., engineers, in 1986 was $599 per week or $31,148 per year. This is a lot money, and the difference in men and women pay is unbelievable. But that is a topic for a different blog article. To put a man’s pay into context, adjusted for inflation, this is $88,763 in today’s money. Every year IRS caps the amount an individual can invest in 401k, and in 1986 this was $7,000 for employee contribution and $30,000 for total contribution. If you max out your 401k contribution every single year, and in 2024 you have invested a total of $542K but you will have a tidy $1.5M in your 401k when you get ready to retire! This excludes any post-50 catch up contributions ($1.59M). All this with a bare minimum 4% growth, when average 401k growth is 4-8%. The required minimum distributions will likely get to you before you live out your savings! This is the power of compound interest and time. Do nothing, just automatically save in your 401k and retire, literally, like a millionaire.

This is what we did for the 10years that we worked in the USA, and its what we would’ve continued to do had we stayed. By far, it is the easiest most-lazy near-passive investment tool with significant tax benefits, and anyone with a reasonable pay should target taking this approach. There are years in which money will be tight and one will feel like making the minimum contribution but, hopefully, these will be the exception and not the norm.

If you take one thing away from these blogs take this – 401ks are awesome. The UK too has an amazing retirement vehicle that seems more generous than what is offered in the USA – salary sacrifice and SIPP. Take advantage of the 401k while you live and work in the USA and maximize the contribution, when possible, and retire as the most laziest millionaire!

Leave a comment