One of our fun vacations to Rome happened this month, which resulted in a substantial expense this month. However, early retirement or not, we have agreed many years ago to reserve 1 full paycheck per year for vacations. So, we have zero guilt about the expense. We believe everyone needs to have atleast one fun money objective – it adds perspective to the frugal days and for us, keeps us focused, with eyes on a short-term (vacation) and a long-term (retirement) prize. Let’s talk about how to fund fun money objectives in a later blog post. Early-on in our savings journey, we used to make a conscious effort to set money aside for the fun stuff and ensure we don’t spend the money on unnecessary things. Now, this has become a habit and we don’t need to force ourselves to allocate the funds.

The “kids activities” category shows up for the first time this month – our son goes through 1 new pair of shoes every month! Unfortunately, not joking. He runs like the wind at parks or in any open space, and scrapes the soles of his tiny toddler shoes down to a millimeter within a few weeks of purchase. Combined with this, he also started a weekend “football” session for kids for 45min on Saturday afternoons. It seems to tire him out and he sleeps better, which means we sleep better. For £20 a month, we think it’s a fabulous deal!

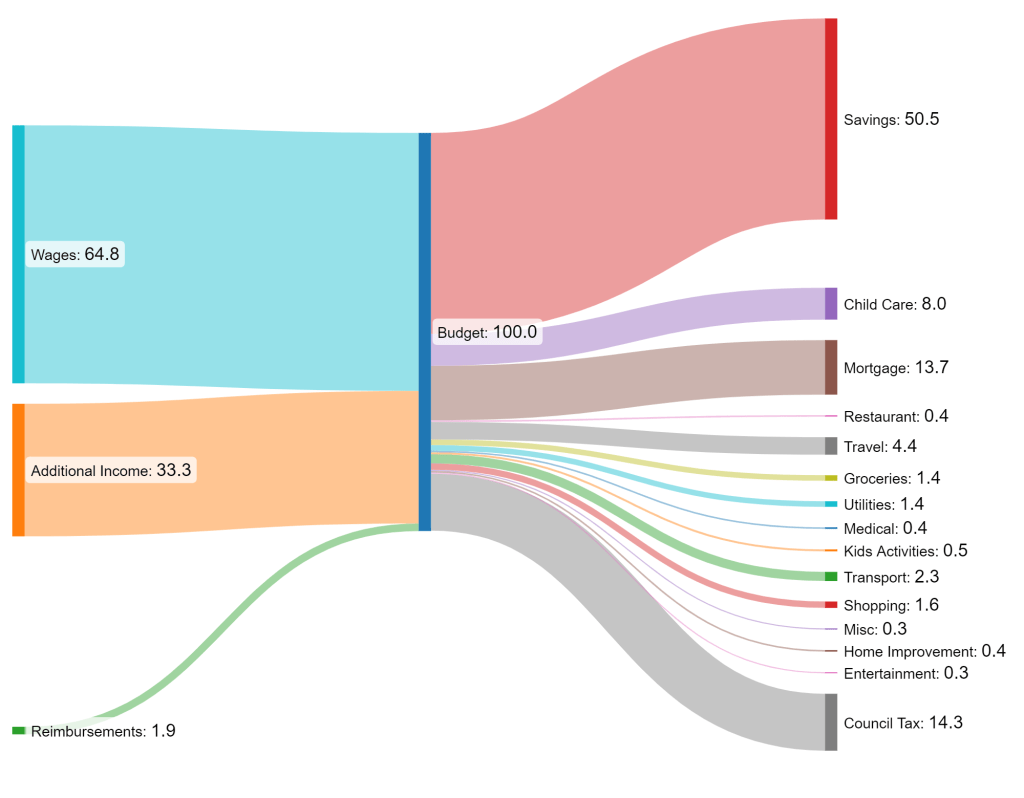

Along with the vacation, our annual council tax is due in March – another 14% of our budget. With Birmingham’s bankruptcy problems, the city council has increased all council tax by 10% (with plans to increase an additional 10% in 2025), and it feels like the council is ensuring we go bankrupt in the process too.

We also had some additional income this month – we got some gift money from S’s parents, which went straight into savings (or to fund the Rome trip, depending on how one looks at it).

Leave a comment