This US government census data source is very interesting, and they key snippet we will focus on –

- The median size of a new single-family home sold in 2022 was 2,383 square feet (221 sq m).

- The median price of new single-family homes sold in 2022 was $457,800, while the average sales price was $540,000.

With the size of American families shrinking, and on average 4 people living in each house, that is roughly 595 sqft and a debt of $135,000 per person, after coming up with a deposit of 15%! At current interest rates of 5.65%, this house will cost the owners $2,859 a month in mortgage, and suck-in a total cost of ownership at $938,977 at the end of 25yrs. These numbers are not just big, they are staggeringly large.

Let’s breakdown the above numbers into a monthly budget. For a family of 4, with 2 earning members, assuming each individual earns $90,000 a year pre-tax, total monthly income pre-tax is $15,000. This is a great monthly income, however if you break it down into actual spend every month, there is no way this is sustainable long-term.

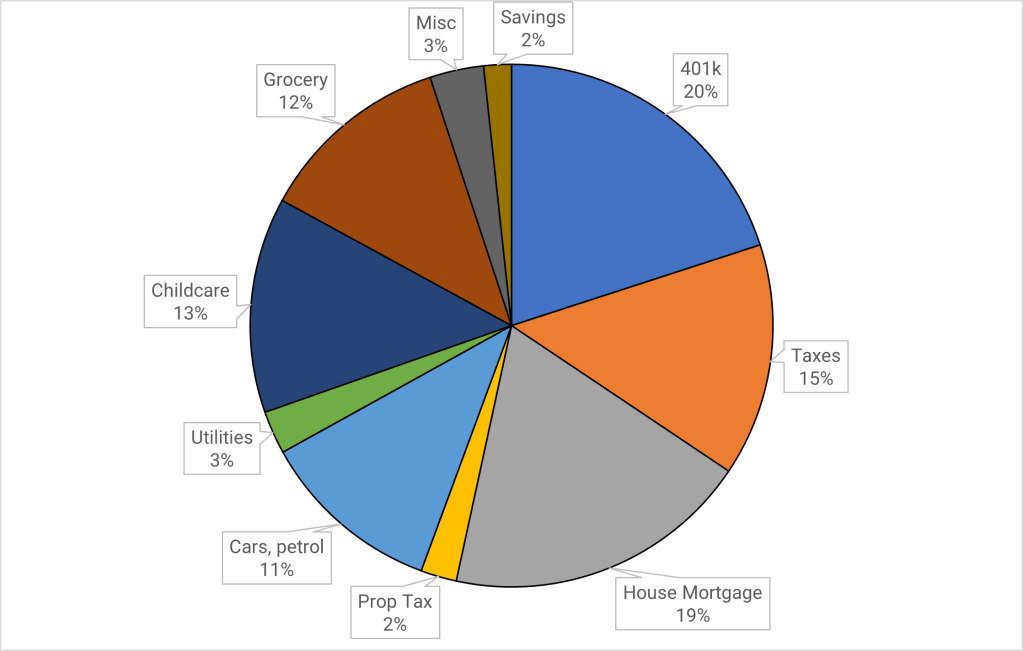

The pie-chart below is used to illustrate this point, with one key assumption – You max out your monthly 401k contribution (unless there are some dire circumstances, this should be your default situation), which that allows you to drop into a 15% tax bracket. If you buy a massive $540,000, with a mortgage of $459,000 (15% downpayment), then your monthly payment is 19% of your post-tax income. Banks will have no problem approving this mortgage application, and you will walk away thinking you have got a good deal from the bank. Unless you have an alternate source of income, this pie chart leaves you 2% monthly savings for any unexpected expenses or vacations!

We guess an argument could be made for dropping 401k contribution to the minimum amount that the employer matches (say 4-6%), but this will have an adverse impact with increase in tax to ~20%. Yes, you would a savings increase from 2% to ~12%, and you could invest this any brokerage account and get the earnings (which will be subject to short or long term capital gains taxes).

The best alternate scenario – buy a house smaller house (without fancy granite or quartz countertops), and ensure you can expand or upgrade the house as your needs change. This will allow you to pay the least amount upfront, have visibility towards a viable financial scenario and make regular upgrades, that will be to your liking.

Our first joint apartment (2012 – 2015) was $700 a month for rent. It was a dumpy 2 bedroom on the common areas but we scrubbed it clean and it was fantastic once you walked through our door. When we decided to buy a house, we our mortgage application was approved upto $350,000, which meant $385,000 with 10% downpayment. Which is a ridiculous number for two individuals who had been working, and saving, only a few years at that point. We saw so many gorgeous huge houses that were around that price point, but our financial fears ruled the day. We were terrified of paying a monthly mortgage that was so far above our rent, and we purchased a 1100 sqft 3 bed 1 bath house for $165,000, at 10% downpayment and 1.9% interest, which resulted in a 25yr mortgage of $622.22 (within our $700 budget!). For the next year, we were able to cut our monthly brokerage investments to 0%, reduced 401k to the minimum contribution, ran our savings to $0, and focused on paying off the mortgage. In hindsight, the brokerage account was giving 5-8% yield and we only had 1.9% interest on the loan, so its pretty dumb financial move to pay off a low-interest loan. Our risk tolerance now is much higher, but at that point, we were petrified of debt. By end of 2016, we had paid off our mortgage and focused on rebuilding our savings and investment portfolio. And every since since paying off the house, we took on one major project – added a mudroom, expanding the house from 1100 sqft to (a very large) 1250 sqft, combining a few tiny rooms to create a large open concept, adding another bathroom, and building a giant deck. And by watching plenty of YouTube videos (thanks Ron Hazelton) we were able to do a lot of the work ourselves. FYI, we built a mudroom, all by ourselves 0 contractors, using this video for reference. Even when we didn’t do all the work, we chipped into every project, we were able to keep costs low for contractors, and added value to the house. With a very heavy heart, we sold this house for $285,000 in June 2022 to relocate to UK. We had invested a total of $207,000 into the house and turned a tidy profit, while learning some useful life skills and keeping within our financial risk tolerance.

Surely not every city or neighborhood will have a decent house for $165,000 (when approved for $350,000). But we would guess the ration would be same, i.e., if the bank thinks you can afford upto a $850,000, the target house you should buy should be < 70% of this value, to ensure you have max’ed 401k and sufficient saved up for any financial emergencies. And this is where we can help – we love math and can help brainstorm plans to help you figure out your mortgage pay-off strategies. So send us an email and let’s see we can solve this together.

Leave a comment