Being an immigrant in the USA, or in any country, is not easy. Most countries have somewhat unfriendly immigration policies, especially if one loses their job while on a work visa. For example, in the USA, while working on a H-1B visa if you are fired or quit, you need to leave the country within 60d. This is simply not sufficient time to move a life that has taken years to built, however, is the situation for so many immigrants. With this uncertainty looming everyday in the back of their minds, immigrants sometimes do not invest in 401k plans to avoid money being “stuck” in the plan, if they need to leave country. However, this is simply not the correct financial approach. Let’s look at a few scenarios in this article.

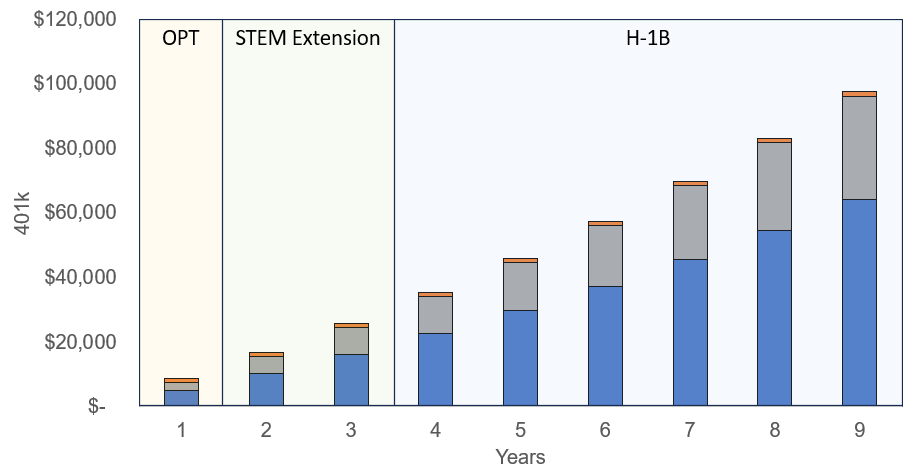

Assume the employee has a base salary of $100,000, and it grows 3% annually. The company matches 100% of employee’s contribution to 401k upto 5% of paycheck, and the employee does this every year. We are assuming a very conservative 4.5% rate of 401k growth in these scenarios.

Scenario 1 – Immigrant employee starts on a OPT visa, then gains a 2yr STEM extension but H-1B is not selected in consecutive lotteries, and needs to leave the country at end of year 3.

If the employee has invested in 401k for 3years, the total 401k pot is $32,293 with passive income of $19,164 (company match and tax reduction). Worst case, highly not recommended, is the employee pays tax and an early withdrawal penalty (total approximately $6,790), and takes the money as cash while leaving the country. And even with this scenario, the employee profits $12,373.

Scenario 2 – Immigrant employee starts on a OPT visa, then gains a 2yr STEM extension after which H-1B is finally selected and the employee works for 6yrs. However, employer choses not to file for Permanent Residency, and employee needs to leave the country at end of year 9. Total in 401k is $96,176 with passive income of $62,986. Of this passive income, employee can keep $49,392, if they choose an early withdrawal and taxes at end of year 9.

The math for these scenarios when employee does the maximum 401k contribution ($16,500 – $18,000) is even more obvious, and shows why this is a no-brainer. If the immigrant employee has some minimal risk tolerance, then under these scenarios, it is significantly advantageous to invest in 401k, while on a visa, and take advantage of time in compound interest.

For scenario purposes, we have shown withdrawing the money, paying the tax and penalty as the option for getting the money in-hand while leaving the country. Practically speaking, and what we have done when we left the USA, is to roll 401k into a traditional IRA with a big brokerage firm, and ensure a robust Roth Conversion Ladder, with minimal taxes. There are a multitude of things immigrants need to worry about – 401k, investment and taxes should not be on that list. You need to do the math, understand your own individual risk tolerance (which can change over time) and make a decision. And if you need to talk to an unbiased team, give us a call!

Leave a comment