To say Warren Buffet is a legend is an understatement. But this is the year we woke up and read and understood his letters to shareholders, and followed his advice of low expense index funds. And it is also the year we opened our Vanguard Brokerage Account. This year, we celebrated our 10yr association with Vanguard, although they probably don’t care nearly as much as we do! We started with $3000, the minimum required for the low index fund (VOO) and we still have this fund today as one of our best performers at 14.3% return. Over the years, we have relied on Vanguard anytime we have wanted to start our research into a market sector in which we haven’t previously invested. By the end of this article, if you learn nothing else about us, you will learn, we love Vanguard. If an opportunity comes up to do an unpaid (or paid) advertisement for them, we would.

Disclaimer – 10yrs later, we don’t really recall why we decided to open T Rowe and Vanguard brokerage accounts simultaneously. Seems like we took portfolio diversification a bit too literally.

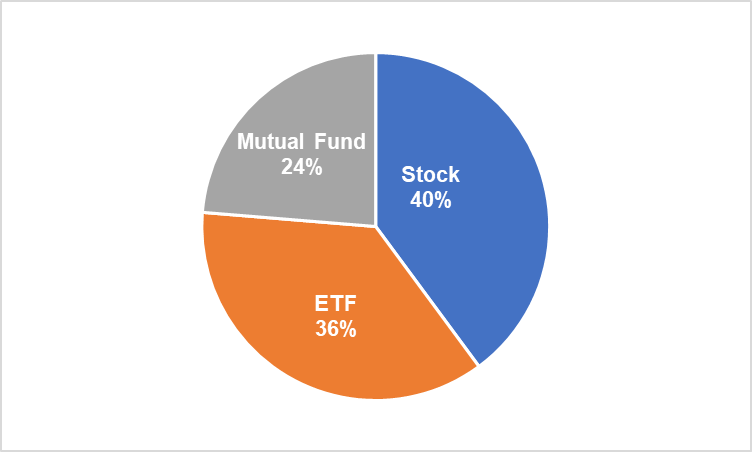

When we review historical performance, it seems we were very tentative to start this account based on the slow trickle of mutual fund investments and small values. Atleast until 2016, for 2 years, we seem to have wasted time and not invested fast enough. Our T Rowe Price investments were also flat, and other than maximizing 401k, I don’t completely recall why we didn’t make any investments. It is likely, we were saving for our house deposit, and wanted to have cash-in-hand (probably the result of one too many HGTV houses, when they buy house with cash) to avoid the hassle of selling stock to raise deposit. After Summer 2017, the our investments in Vanguard have been the only account for a few years until we opened a Fidelity account many years later. Slowly, we diversified, in the real sense, into different market segments, investment types, risk profiles and now have 40% stock, 36% ETF and 24% mutual funds.

Leave a comment