A journey of a thousand miles, or dollars, begins with one step. And in May 2014 we opened our first joint brokerage account at T Rowe Price. Major photo worthy milestone, done from our $90 Walmart futon couch. While we chose very good index funds, little did we know the impact of TRP’s higher expense ratios. The same cousin who advised me in 2011 to max out my company’s 401k, also held an account with TRP, and not knowing much better, we blindly followed. He led us right once, ofcouse we didn’t question it!

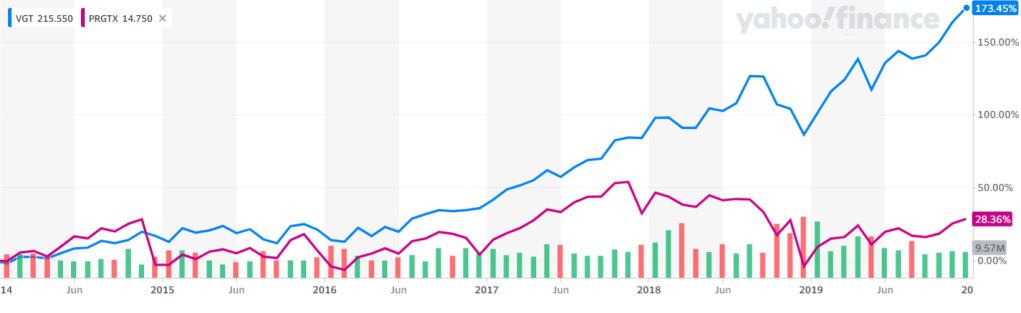

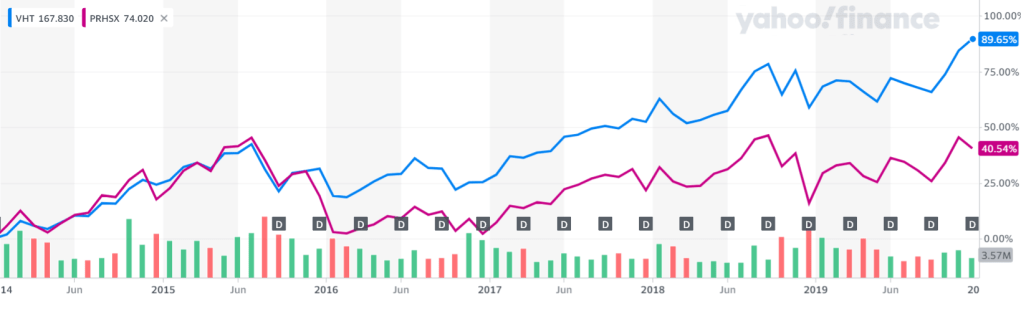

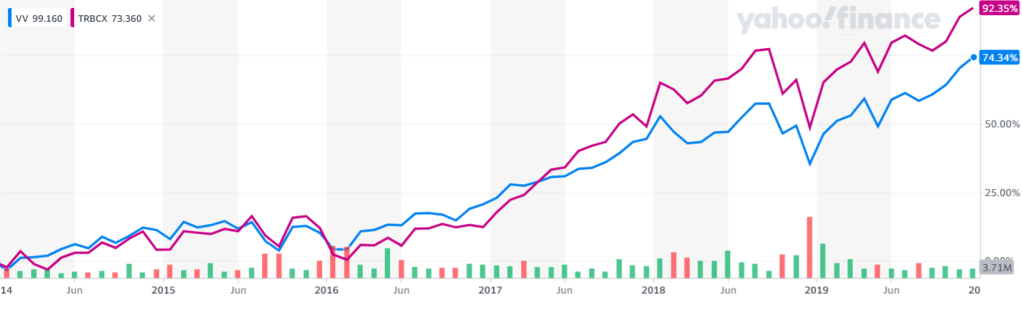

We bought the minimum amount ($2,500-$3000) each of PRGTX, PRHSX and TRBCX to open our account. For the first two years all was well, and we were happy with our decisions, and didn’t make any additional investments in these three mutual funds. Then, as we stared to reach more about low-expense ratio ETFs, we found very comparable VGT, VHT and VV to PRGTX, PRHSX and TRBCX respectively. And in mid-to-late 2016 is when Vanguard ETFs really began to take-off while TRP remained relatively stable. We distinctly remember discussing this topic in 2017, but we were hesitant to liquify TRP to switch over to Vanguard ETFs, at what was perceived to be a high price. Looking at the graphs below now, buying the ETFs at 2017 prices would have been a steal.

Let’s dive deep into PRGTX vs VHT example-

- Expense ratio PRGTX 0.95% and VHT 0.1%

- Assuming both grow at 7%, the effective growth rate for PRGTX is 6.05%, whereas VHT is 6.9%

Over a 10yr period, a $10,000 investment would yield $17,993 in PRGTX but $ 19,488 in VHT – a whopping 8.3% lower due to a higher expense ratio. Let alone the fact that PRGTX only grew 28.36% and VHT grew an eye-popping 173.45%.

A lot of first-time investors, like us, and seasoned investors, like my cousin, get pulled into the trap of actively managed funds, and these may have been essential prior to the introduction of tracker / passive / index funds, active funds. Active fund managers devote their daily waking hours to molding their funds with stocks that they expect will beat the market return, and should definitely charge a higher expense fee. However, cost is the killer and choosing low-cost passive funds will the end-investor keep majority of the returns.

In hindsight, we also recognize a few bad data tracking practices with this specific TRP account. Over time, since a comparatively small sum was held in the T Rowe Price account, we never logged into it on a frequent basis or checked its performance and calibrated against similar index funds from other brokerage firms. Needless to state, this account was closed in 2020 (I’m not sure why we even kept it for so long, we definitely knew better by mid-2016), and we moved all the money to comparable Vanguard funds. Hurray for cheap index funds. This also helped us reduce our brokerage account complexity, hence allowing us to manager fewer accounts better.

And keeping our mistake count tracker alive –

Mistake #4 – Not paying attention to expense ratios. Now we know better.

Mistake #5 – Having multiple accounts (bank accounts, credit card accounts, brokerage firms, etc.) takes additional effort to track and ensure all is well. It is best to consolidate where possible, and where financially viable. While we did very well with multiple credit cards, we didn’t track well for multiple brokerage firms for awhile and probably lost some money due from it.

Leave a comment